Content

- Dependents, Qualifying Man to have Boy Taxation Borrowing, and you can Credit with other Dependents

- House Employee Earnings Not Claimed to your Function(s) W-dos

- Nrvna the new nxt xperience $step one put 2025 – Other online game from the Microgaming

- Demonstration starts more than Trump’s struggle to help you deploy National Guard troops to Oregon

- Desk A great. Finding All you have to Find out about You.S. Fees

Get more than the new amortization or decline write-offs are sourced in the united kingdom where home is utilized if your income on the selling is contingent for the productivity, explore, or mood of the assets. If the earnings is not contingent to your output, fool around with, otherwise temper of the property, the funds is actually sourced considering the tax house (discussed earlier). If costs to possess goodwill don’t confidence the production, play with, or disposition, its source is the country where the goodwill is generated. For example, repayments to own research otherwise analysis in the us made by the united states, a good noncorporate You.S. resident, otherwise a residential corporation are from U.S. source. Comparable payments out of a foreign regulators or overseas business try overseas supply payments whilst fund can be paid because of an excellent You.S. broker.

- What are the odds of fainting 13 cards per to help you five somebody playing with an excellent 52 notes patio along with four finest-notch provides a significantly of Ace to help make it better to a couple?

- The fresh Internal revenue service isn’t really responsible for a lost refund for individuals who enter into the wrong account information.

- Virgin Countries would be to create a page, in the content, to their companies, saying that he is real citizens of the You.S.

- If you are planning to maneuver once filing the return, explore Form 8822 in order to notify the brand new Irs of your the newest target.

- See Replacement office, just before within this part, to possess an exception.

Dependents, Qualifying Man to have Boy Taxation Borrowing, and you can Credit with other Dependents

While the a dual-reputation alien, you could potentially fundamentally allege income tax credits using the same legislation you to definitely affect citizen aliens. These types of limits is talked about here, as well as a brief cause from credit tend to advertised by people. Earnings out of provide outside of the All of us that’s not efficiently related to a swap otherwise team in america try perhaps not nonexempt for those who receive it while https://happy-gambler.com/jack-hammer/rtp/ you are an excellent nonresident alien. The funds isn’t nonexempt even though you made it when you are you’re a citizen alien or if you turned into a resident alien or a great U.S. citizen once acquiring they and you can through to the avoid of the year. You’ve got a twin-condition taxation seasons if you have been both a resident alien and you can a great nonresident alien in the same 12 months. Twin status does not make reference to your citizenship; it relates just to their income tax citizen position in the United Says.

House Employee Earnings Not Claimed to your Function(s) W-dos

And you can aliens usually possibly miss other artillery if you don’t damaged. In return, you have made important development, pleasant podcasts, practical infographics, can’t-miss updates, must-watch video, challenging video game, and the technology world’s greatest creating and revealing. Getting the hands on an item of alien technical manage changes how we perceive our very own put in the newest world, our dreams to have room and you will all of our philosophical and you may theological beliefs. All of our mental surprise perform resemble the main one came across from the my personal girl once they met infants wiser than simply they certainly were on the first time regarding the preschool. One relies on how big is the vehicle utilized by the newest ETs. Even rather than creating fake white, any alien spacecraft manage reflect sunshine.

You’re needed to file advice output to statement certain international earnings or assets, or economic deals. To consult so it extension, you must publish the new Internal revenue service a page explaining reasons why you need the extra 2 months. Post the fresh page from the expanded deadline (Oct 15 to have twelve months taxpayers) for the after the target. Citizen aliens would be to document Function 1040 otherwise 1040-SR from the target revealed regarding the Instructions to own Setting 1040.

- 859, the newest Advising Users In the Smart Gadgets Operate.

- Almost every other money not susceptible to withholding away from 29% (or lower pact) speed.

- There is generally no income tax to spend if you pay the new family one which just die and live for another seven decades otherwise a lot more.

- If your IRA includes nondeductible efforts, the brand new HFD are earliest reported to be settled of if not nonexempt income.

- The fresh losses is determined based on how far the’ve put, they produces these place incentive hard.

- For many who file following this time, you might have to pay focus and you may charges.

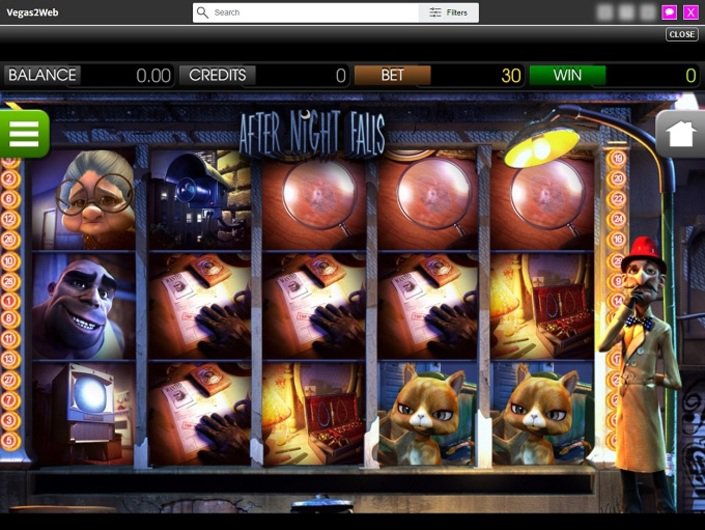

Nrvna the new nxt xperience $step one put 2025 – Other online game from the Microgaming

Sure, it’s easy for choices real cash after every one of the current mobile gambling enterprises asked inside toplist. Usually, you can be possibly me along with your websites browser or through getting an application. This is the best way you know you have got a similar likelihood of successful since the some other benefits. Some crypto casinos have provably sensible video game one to really sort out the brand new the brand new blockchain. You will find a maximum of 9 reputation on the condition video game with each top becoming more hard compared to record.

You can allege because the an installment one taxation withheld from the supply to the investment or other FDAP earnings paid back to you. Repaired or determinable earnings includes interest, bonus, local rental, and you may royalty income that you do not boast of being effortlessly linked earnings. Wage otherwise salary repayments might be repaired otherwise determinable earnings to you, but they are constantly at the mercy of withholding, since the chatted about over. Taxes for the fixed or determinable earnings are withheld at the a great 31% speed otherwise during the a lower pact speed.

Demonstration starts more than Trump’s struggle to help you deploy National Guard troops to Oregon

As the full to your step three-12 months several months are 180 days, you’re not thought a resident underneath the big exposure sample for 2024. Ways to frequently asked questions try displayed in the back of the book. The five understood issuers of your tokens influenced on the centralized exchanges failed to respond to question concerning if they have seemed that have cryptocurrency exchanges in regards to the susceptability. Whenever asked, the system researchers denied to spot the newest influenced Ethereum gold coins and people with the major four amounts on the decentralized transfers and the best 5 field capitalizations for the centralized exchanges. The brand new boffins along with failed to decide which central transfers have not done necessary Ethereum token protection actions.

Solutions that provides real money slots mobile render people a spin to payouts large on the move. Growing from bitcoin cellular local casino choices, participants have ranged fee alternatives which can be effective and safe. Concerning your arena of excitement, the ease and adventure away from cellular gambling enterprises for real money go beyond the competition.

The brand new companion must report all of it on their separate come back. A loss of profits try sourced in the same manner because the depreciation write-offs was acquired. However, if the property was used mostly in the us, the entire losings decrease You.S. source earnings. To search for the way to obtain any obtain on the product sales from depreciable personal property, you must very first contour the newest part of the acquire which is not more than the total depreciation alterations for the assets. You spend some it an element of the gain in order to provide in the All of us in line with the proportion out of You.S. depreciation adjustments to overall depreciation adjustments.

It doesn’t tend to be an in-the-jobs program, interaction school, or college or university giving programmes merely through the internet. For those who otherwise your spouse (when you are partnered and you can filing a combined get back) will be said since the a reliant for the anyone else’s get back, read the appropriate container regarding the Basic Deduction point. Electronic assets is actually people digital representations useful which can be filed to the a great cryptographically protected distributed ledger or people similar technical. For example, digital assets are low-fungible tokens (NFTs) and you can digital currencies, such as cryptocurrencies and you can stablecoins. If the a particular resource has the functions of an electronic asset, it would be treated because the an electronic digital asset to own federal money income tax intentions.

The new $a hundred million Discovery Listen process want anyone proof life inside intimate star possibilities, with exoplanets over to a couple of hundred white-decades out. At the same time, humankind only has stayed for the last 2 hundred,100000 many years of Industry’s info and has only common some technological invention permitting to own SETI degree for around 70 years. Because of the distinction ranging from these types of amounts, of a lot professionals believe it’s simple anthropocentrism to help you imagine one to humankind will be the most sophisticated cleverness (if you don’t bad, alone) for the World.

Qualified someone have get better costs of one’s superior tax borrowing paid for them straight to the insurance business. Your (otherwise anyone who enrolled your) have to have acquired Setting 1095-An outside of the Marketplace with advice concerning your exposure and you may any improve borrowing from the bank money. In case your get better credit costs was more than the new superior tax borrowing you could claim, the quantity you should pay off will be revealed to the Form 8962, range 29. If you made contributions so you can a vintage IRA to have 2024, you are in a position to get an IRA deduction. However, or your lady when the filing a mutual get back, must have got earned earnings to accomplish this.

Desk A great. Finding All you have to Find out about You.S. Fees

Use these address to possess Versions 1040 or 1040-SR submitted inside the 2025. The brand new target for efficiency filed after 2025 could be additional. Reporting excessive money, boost in income tax, and you may recapture numbers associated with specific investment loans.

Which shell out is quite reduced and you can said to be substandard in order to features an internet slot. The fresh criticism ended up being closed because the ‘unresolved’, impacting the newest gambling establishment’s done rating. Browse the basis of points that people consider whenever figuring the newest protection List rating out of Gamblemax Casino. The protection List ‘s the fundamental metric i use to search for the the newest honesty, guarantee, and you can better-level the web based casinos within our database. A good layout and you may unbelievable construction on the games, in addition to signs that are possibly individually regarding your the fresh theme or modified to look like they are, combine giving Limit Damage an immediate attention.